Free Trade Agreement between Hong Kong, China and the Association of Southeast Asian Nations

Quick Reference Guide for Exportation of Goods to ASEAN under the ASEAN-Hong Kong, China Free Trade Agreement (AHKFTA)

1. What are the issues that I need to take note if I would like to enjoy preferential tariff treatment for my goods under the AHKFTA?

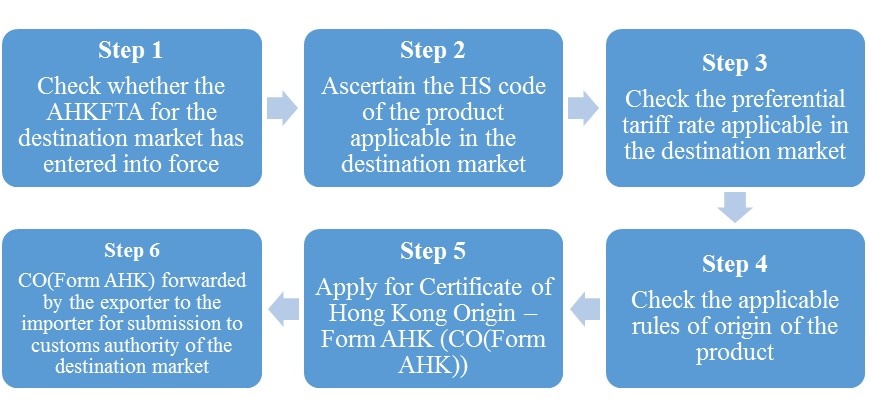

For the purpose of enjoying preferential tariff treatment under the AHKFTA, the major issues to take note are set out in the step-by-step flow-chart below:

2. How do I ascertain the tariff classification (i.e. HS code) of my product applicable in the destination market?

Hong Kong traders are advised to consult their importers or the customs authority of the importing AMS on the HS code of the product. The HS code is used for checking the relevant preferential tariff treatment and the applicable rules of origin under the AHKFTA.

Alternatively, Hong Kong traders may consult the Census and Statistics Department (C&SD) for the Hong Kong Harmonized System (HKHS) code of the product for reference purposes <https://www.censtatd.gov.hk/trader/hscode/index.jsp>. The first 6 digits of the HKHS code should reconcile with those of the HS code applicable in the destination market.

Whilst the first 6 digits of the HS codes are universal between Hong Kong and AMS, individual AMS may adopt slightly different HS nomenclature to suit their own needs. For the purpose of facilitating customs clearance proceedings, traders are strongly reminded to confirm the full HS code applicable in the destination market with the importers or the customs authority of the importing AMS.

3. What is the preferential tariff rate of my product intended for export to the destination market?

According to the HS code of the product concerned, traders may check the preferential tariff rate by way of the following means:

- Checking by AMS - Tariff reduction schedules grouped under individual AMS "Annex 2-1 (Schedules of Tariff Commitments) of the AHKFTA"

<https://www.tid.gov.hk/english/ita/fta/hkasean/text_agreement.html> - Checking by HS Chapter - Tariff reduction schedules grouped under HS Chapters "Tariff Reduction Commitments of AMS by Commodity"

<https://www.tid.gov.hk/english/ita/fta/hkasean/tig.html>

In general terms, the corresponding preferential tariff rates in particular years are set out under the column "AHKFTA Tariff Rate (%)". In the event that certain codes are specified (i.e. "EL", "MFN", "N.O" or "U"), it means that there are no tariff reduction commitments under the AHKFTA. For illustration purposes, a mock-up of the tariff reduction schedule is set out below:

| HS Code | Description of Goods | Base Rate (%) | AHKFTA Category | AHKFTA Tariff Rate (%) | |||||

|---|---|---|---|---|---|---|---|---|---|

| 2019 | 2020 | 2021 | 2022 | ... | 2028 | ||||

| HS Code A | Product A | 10 | NT2 | 9 | 8 | 7 | 6 | ... | 0 |

| HS Code B | Product B | 10 | EL | EL | EL | EL | EL | ... | EL |

- For Product A, the preferential tariff rate is 9% in 2019, 8% in 2020,… and 0% in 2028; and

- For Product B, it belongs to "EL" category which means it is on "Exclusion List" and thus there are no tariff reduction commitments from the AMS concerned. Non-preferential tariff rate will apply.

Traders may consult the TID on the preferential or non-preferential tariff rates by filling in the "Tariff Enquiry Form" at the following link:

<https://www.tid.gov.hk/english/trade_relations/tariffenquiry/tariffenquiry.html>

4. What is the applicable rule of origin (ROO) of my product intended for export under the AHKFTA?

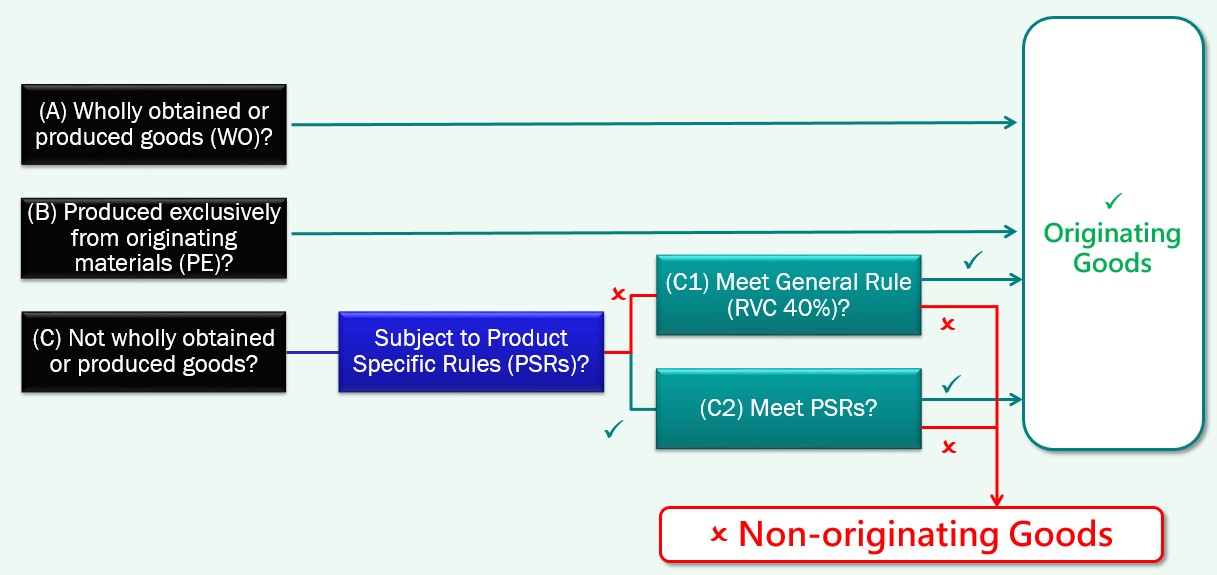

Generally speaking, a product is considered as originating under the AHKFTA if it conforms to the ROO requirements under one of the following conditions:

- It is wholly obtained or produced in Hong Kong [WO]

Example: Fresh fruit grown in Hong Kong - It is produced in Hong Kong exclusively from originating materials from Hong Kong and/or AMS [PE]

Example: Instant coffee manufactured in Hong Kong from coffee beans originating in Viet Nam, sugar originating in Thailand and milk powder originating in Singapore - It does not meet WO or PE requirements but is subject to and can meet the Product Specific Rules (PSR) under Annex 3-2 of the AHKFTA [PSR]

(Exporters / manufacturers may click here (pdf format) for the PSR list and check the origin criteria of the respective products by making reference to their HS codes)

Example: Aluminium plates, sheets, and strip, of a thickness exceeding 0.2mm of HS heading 7606, with change in tariff heading (CTH) applied, are manufactured with unwrought aluminium of HS heading 7601 - It does not meet WO or PE requirements and is not subject to PSR, but can meet the regional value content requirement as defined in the AHKFTA [RVC]

(There are two formulas for calculation of RVC (see below))

Example: Beer brewed in Hong Kong with RVC of not less than 40% of its free-on-board (FOB) price in Hong Kong

A simplified diagram which facilitates the determination of the applicable ROOs for a particular product is also prepared for reference:

Two formulas for calculation of RVC are provided in the AHKFTA:

- Direct/Build-up Method

RVC = AHKFTA Material Cost + Direct Labour Cost + Direct Overhead Cost + Other Costs + Profit ×100% FOB Price

- Indirect/Build-down Method

RVC = FOB Price - Value of Non-Originating Materials, Parts or Produce ×100% FOB Price

For the purpose of determining whether a product is originating and eligible for preferential tariff treatment, it should be noted that WO, PE, PSR and RVC have to be considered in conjunction with the other requirements set out in Chapter 3 (Rules of Origin) of the AHKFTA, such as Accumulation, Minimal Operations and Processes, Direct Consignment, De Minimis, etc.

For example, the Article on Minimal Operations and Processes required that a product shall not be considered to be originating if only minor and simple processes, as specified in the Article, are undertaken, even if other ROOs such as RVC can be met. For details about Minimal Operations and Processes and other ROO-related requirements, please refer to Chapter 3 of the AHKFTA <https://www.tid.gov.hk/english/ita/fta/hkasean/text_agreement.html> and Certificate of Origin Circular No. 4/2009 <https://www.tid.gov.hk/english/aboutus/tradecircular/all_in_one/2019/as052019.html>.

5. How do I apply for a Certificate of Origin (CO) to cover my goods intended for export under the AHKFTA?

Hong Kong exporters and manufacturers (and subcontractors, if any) will need to take out a Certificate of Hong Kong Origin - Form AHK (CO(Form AHK)) from the TID or one of the Government Approved Certification Organizations (GACOs) to cover their goods for export under the AHKFTA. CO(Form AHK) applications can be made to TID or GACO through one of the CO Electronic Service Providers. Manufacturers (and subcontractors, if any) of the subject goods must first register under Factory Registration with TID before they can apply for CO(Form AHK) to cover their exports.

Each CO(Form AHK) can be used to cover one consignment of goods entering into an importing AMS under the AHKFTA. Under normal circumstances, traders are required to apply for a CO(Form AHK) before exportation of goods, and the departure date should be at least 2 clear working days after the date of application.

Some useful links are provided below for further information:

Factory Registration

CO(Form AHK) and relevant Certificate of Origin Circulars

Notes for Traders Lodging CO(Form AHK) Applications

Electronic Service for CO

GACOs:

Hong Kong General Chamber of Commerce

Federation of Hong Kong Industries

Chinese Manufacturers' Association of Hong Kong

Indian Chamber of Commerce, Hong Kong

Chinese General Chamber of Commerce

6. Is there a waiver for CO(Form AHK) for exportation of my goods to AMS under the AHKFTA?

Under the AHKFTA, a CO(Form AHK) is not required if the FOB value of a consignment of Hong Kong-origin goods does not exceed US$200.

February 2021