Quick Reference Guide on Rules of Origin for Exportation of Goods under the Free Trade Agreement between Hong Kong, China and Australia

Quick Reference Guide on Rules of Origin for Exportation of Goods under the Free Trade Agreement between Hong Kong, China and Australia

Under the Free Trade Agreement between Hong Kong, China and Australia (the Agreement), Australia has agreed to eliminate all customs duties on Hong Kong-origin goods, subject to the relevant rules of origin being met and the relevant operational procedures being complied with.

This Guide aims to provide some quick reference for the major requirements under the Agreement for claim of preferential tariff treatment when exporting goods to Australia. The full text and other details of the Agreement are available on the Trade and Industry Department (TID)'s webpage (https://www.tid.gov.hk/en/our_work/trade_and_investment_agreements/ftas/australia/agreement.html). Traders are advised to read the relevant provisions of the Agreement and its Annexes, Circulars issued by TID as well as updated information posted on TID's website, in conjunction with this Guide.

1. What goods are qualified for preferential tariff treatment under the Agreement?

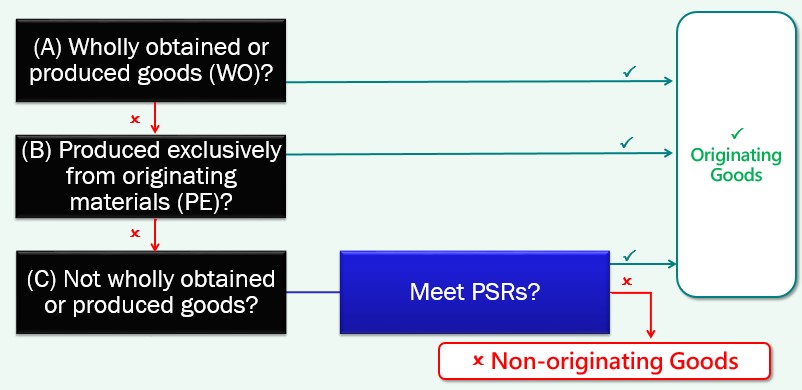

Generally speaking, all Hong Kong-origin goods could enjoy the tariff-free treatment when being exported to Australia if they meet all applicable requirements of Chapter 3 (Rules of Origin and Origin Procedures) of the Agreement. A good will qualify as originating if it meets any one of the following conditions:

- wholly obtained or produced entirely in the Area of Hong Kong and/or Australia by one or more producers

Example: Fresh fruit grown in Hong Kong - produced entirely in the Area of Hong Kong and/or Australia by one or more producers, exclusively from materials originated from Hong Kong and/or Australia

Example: Biscuits manufactured in Hong Kong from wheat flour originating in Australia and milk originating in Hong Kong - produced entirely in the Area of Hong Kong and/or Australia by one or more producers using materials originated from places outside Australia and/or Area of Hong Kong, and satisfies the Product Specific Rules (PSRs) set out in Annex 3-B (Product-Specific Rules of Origin) of the Agreement

Example: Aluminium plates, sheets, and strip, of a thickness exceeding 0.2mm manufactured in Hong Kong from unwrought aluminium originating in Japan

A diagram which facilitates the determination of the applicable rule of origin for a particular product may be found below for reference:

2. How to identify the applicable PSR for a good produced with non-originating materials?

The PSRs are set out in Annex 3-B (Product-Specific Rules of Origin) of the Agreement in accordance with the Harmonized System (HS). Traders may identify the applicable PSR for a specific good in Annex 3-B (Product-Specific Rules of Origin) of the Agreement with its HS classification code. Explanations of the major PSRs under the Agreement are set out below:

- CC means change of Chapter (i.e. non-originating materials used in the production of the good must be classified in a different Chapter (change at two-digit level) from the classification of the good);

- CTH means change of heading (i.e. non-originating materials used in the production of the good must be classified in a different heading (change at four-digit level) from the classification of the good);

- CTSH means change of subheading (i.e. non-originating materials used in the production of the good must be classified in a different subheading (change at six-digit level) from the classification of the good); and

- RVC(40) means that the good must have a regional value content of not less than 40%, using the build-down method specified in the Agreement. (Please refer to Q3 for details on the build-down method.)

Example A:

| HS2017 | Subheading | Description | Product-Specific Rule of Origin |

|---|---|---|---|

| 2103 | Sauces and preparations therefor; mixed condiments and mixed seasonings; mustard flour and meal and prepared mustard | ||

| 2103.10 | - Soya sauce | CC or RVC(40) |

Soya sauce (classified in HS Chapter 21) is manufactured in Hong Kong from non-originating dried soya beans (classified in HS Chapter 12). As the non-originating materials have undergone a change in tariff classification at a two-digit level, the CC rule can be met.

Example B:

| HS2017 | Subheading | Description | Product-Specific Rule of Origin |

|---|---|---|---|

| 7606 | Aluminium plates, sheets, and strip, of a thickness exceeding 0.2mm | ||

| 7606.11 | - Rectangular (including square): of aluminium, not alloyed | CTH | |

| 7606.12 | - Rectangular (including square): of aluminium alloys | CTH | |

| 7606.91 | - Other: of aluminium, not alloyed | CTH | |

| 7606.92 | - Other: of aluminium alloys | CTH |

Aluminium plates, sheets, and strip, of a thickness exceeding 0.2mm (HS heading 7606) is manufactured in Hong Kong from unwrought aluminium originating in Japan (HS heading 7601). As the non-originating material has undergone a change in tariff classification at a four-digit level, the CTH rule can be met.

3. How to calculate the regional valuation content (RVC) of a good?

RVC should be calculated in accordance with the following formula:

where:

- RVC is the regional value content of a good, expressed as a percentage;

- VNM is the value of non-originating materials**, including materials of undetermined origin, used in the production of the good; and

(**: non-originating materials means a material that does not qualify as originating in accordance with Chapter 3 of the Agreement) - Adjusted Value is

(a) the FOB value (i.e. the value of the good free on board inclusive of the cost of transport to the port or site of final shipment abroad calculated in accordance with the Customs Valuation Agreement); or

(b) if there is no FOB value or it is unknown or cannot be ascertained, the "customs value of imported goods" determined in accordance with the Customs Valuation Agreement.

4. What is meant by "Accumulation" under Article 3.8 of the Agreement?

In accordance with the Agreement, if an originating good of Australia is used in the production of a good in Hong Kong, it should be treated as an originating material in Hong Kong.

5. What is meant by "De Minimis" under Article 3.9 of the Agreement?

A good that contains non-originating material that does not satisfy the applicable change in tariff classification requirement (i.e. CC, CTH or CTSH as mentioned in Q2) required under the PSRs is nonetheless an originating good if:

- the value of all these non-originating materials does not exceed 10% of the Adjusted Value; or

- for a good classified in HS Chapters 50 through 63, the total weight of all such materials does not exceed 10% of the total weight of the good, or the total value of all such materials does not exceed 10% of the Adjusted Value.

Example: Apart from having a non-originating material of which the value is 8% of the Adjusted Value of the good, all other non-originating materials can comply with the CC rule (change in Chapter) as required under the PSRs. In accordance with the "De Minimis" rule, the good can still qualify as originating under the Agreement.

6. How to claim the preferential tariff treatment under the Agreement?

An importer in Australia may make a claim for preferential tariff treatment, based on a declaration of origin completed by the exporter, producer or the importer or an authorised representative of the exporter, producer or importer.

While the declaration of origin needs not follow a prescribed format, it should:

- be in writing, including electronic format;

- be in English;

- specify that the good is both an originating good and meets the requirements of Chapter 3 (Rules of Origin and Origin Procedures) of the Agreement; and

- contain a set of minimum data requirements as set out in Annex 3-A (Data Requirements) of the Agreement.

An illustrative example of the declaration of origin can be found at Annex for reference.

7. Do I need a declaration of origin for my goods if they are of a value of 250 Australian dollars?

In accordance with the Agreement, a declaration of origin is not required if the customs value of the importation does not exceed 1,000 Australian dollars or any higher amount as Australia may establish.

January 2020